Escheatment of Unclaimed Checks

Overview of Escheatment of Unclaimed Checks

Escheatment is the process of transferring abandoned or unclaimed property to the state where the owner’s last known address is located. The state then becomes the custodial holder of the property

Basically, any property that has remained unclaimed by the owner for more than one year for payroll checks or five years for other checks is presumed abandoned. After a property becomes “abandoned”, it must be reported and remitted to the state Commissioner of Revenue

In oracle new release we have a process introduced to Find out and escheat unclaimed checks issued for payments to suppliers, or issued to employees for expense payments, that haven’t been presented for clearing during a specific period of time, and transfer the amount to the appropriate local authority. You can also generate a report with a list of payments that are escheated or initiated for escheatment.

How Business will get Benefit with this new feature in Oracle cloud:

Escheatment is a legal process in which the government takes control of assets unclaimed for a long time. The state authority holds abandoned properties or dormant accounts for a limited period. It, thus, allows the owner, beneficiary, or legal heir to reclaim them. Proceeds from the sale of these assets go toward state funds. Failure to comply with state unclaimed property laws can allow the state to take legal actions against the holder in addition to charging high penalties. This features improves compliance with legal regulations by reporting unclaimed check payments which are not cashed in a specific time period and transfer such payments to the escheatment authority.

Application Access Requirements

The new privilege predefined Escheat Unclaimed Payments is required to secure the Initiate Escheat and Escheat and Create Invoice actions in the Manage Payments page. This new privilege is added to the predefined duty role Payables Payment Processing Duty. This duty role is assigned to the predefined Accounts Payable Supervisor and Accounts Payable Manager job roles.

Escheatment Configurations in Oracle Fusion:

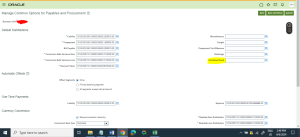

- Assign UNCLAIMED FUND account at Common Options for Payables and Procurement

- Navigate to setup & Maintenance >>Manage Common Options for payables and procurement

- Add unclaimed fund account and save, close it

- Define Minimum days to initiate escheatment process

- Navigate to setup & Maintenance >>Manage Payment Options

- Under Escheatment add minimum days

- Changes to the SLA

- Navigate to setup & Maintenance >>Manage Accounting Methods>>select the SLA method and open it

- Click on + ICON to add the new event class

It will show the new line to add event class and event type as escheatment

Fill & save Escheatment and activate it

![]()

Escheatment Process and Invoice Creation Steps:

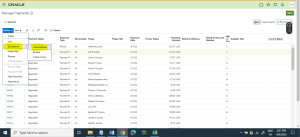

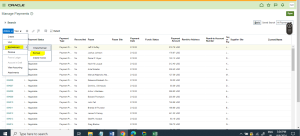

- In Manage Payments page, identify the stale check payments using the configured payment date criteria. Stale payments are any checks that weren’t cleared after the minimum number of days before they become eligible for escheatment.

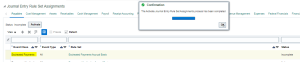

- Select one or more stale payments, then select the Initiate Escheat action. After payment is initiated for escheatment, the payment status will be changed to Escheatment Initiated.

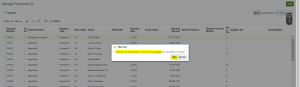

It will show a warning message and click ok to initiate Escheatment

- Send stop payment instructions manually to the corresponding banks for all payments in the Escheatment Initiated status.

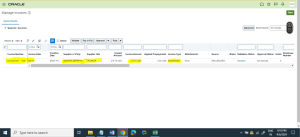

- After performing due diligence on all stale dated payments, use the Manage Payments page to search for and select payments in the Escheatment Initiated status and submit the Escheat action.

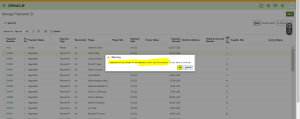

It will show a warning and click on OK

- The payments status changes to Escheated. There is no further activity on escheated payments.

- Run the Create Accounting process on the escheated payments to transfer the amounts from the Cash or Cash Clearing account, to the Unclaimed Fund account.

- Select the escheated payments for the applicable escheatment authority, then select the Create Invoice action to and create an invoice.

- Search for and select the Escheatment authority supplier to create the invoice for this authority.

- Review Escheatment Invoice from Manage Invoice page.

- An Escheatment invoice distribution is created using the Unclaimed Fund account that was credited when the payment was escheated.

What are the Accounting Entries get generated?

Accounting Entries for the Payment and Escheated Payment when Offset Segments option is set to None and Account for Payment option is set to at Payment Issue and Clearing.

#When Normal/Actual payment is accounted:

Dr Supplier Liability Account

Cr Cash/Cash Clearing Account

#When Normal/Actual payment is escheated:

Dr Cash/Cash Clearing Account

Cr Unclaimed Fund Account

#Create invoice Automatically on Escheatment Authority:

Dr Unclaimed Fund Account

Cr Escheatment Authority Liability Account

Note: Generation of accounting entries for the escheated payment will be different based on Offset Segments and when to account payment options.

Reports Available:

- Run the “Escheated Payments Listing Report” for a list of Escheated and Initiated for Escheatment payments.

- Run the Remittance of Payments to Escheatment Authority Listing Report to review payments remitted to escheatment authority

Tips and Considerations

- You must account an escheated payment before you create the escheatment invoice.

- You can’t create escheatment invoice for stale payments that settle invoices belonging to different invoicing business units and legal entities.

- You can only create escheatment invoices for the escheatment authority supplier site assigned to the invoicing business unit.

— Nagaraju Mutakaratapu

Oracle Principal Consultant