Withholding tax:

Withholding tax is an amount of which deduction takes place directly from the earning of an employee by the employer. It is paid to the government as a part of the tax liability of an individual.

Withholding tax is also known as Retention tax. As per the Income Tax Act, under section 195, it is obligatory for the payee, who is the person responsible to make a payment, to deduct the tax at the time of payment or at the time of crediting the payment in the account of the Non-Resident Individual.

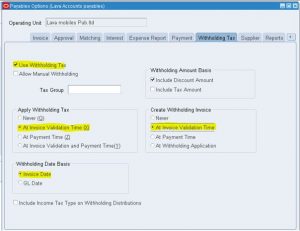

Withholding tax setup in oracle application:

Step 1: Enable withholding tax in payables options

path: Accounts payables>> Setup >> options >> payable options

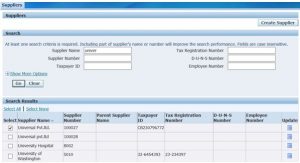

Step 2: Create withholding tax code

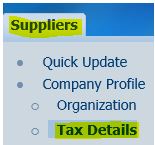

path: Accounts payable >> suppliers >> entry

The below steps explain how to create withholding tax code for a particular supplier

| S1 | enter supplier name |

| S2 | click go |

| S3 | click the supplier |

| S4 | click update |

S5: click the tax details

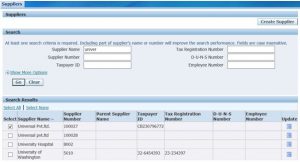

Step 4: Update supplier

Path: AP>> Supplier >> Entry

| S1 | enter supplier name |

| S2 | click go |

| S3 | click the supplier |

| S4 | click update |

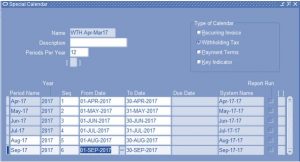

Step 5: Special calendar

Path: AP >> Supplier >> Entry

In case its necessary to automate WTH tax for supplier invoice, then we need to create special calendar with the type “Withholding Tax”

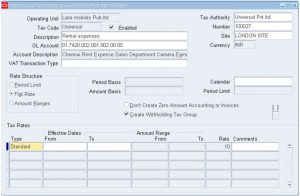

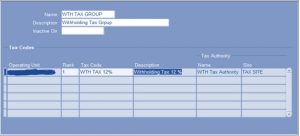

Step 6: Withholding tax code creations

Path: Accounts payables >> Setup >> Tax >> Withholding >> codes

Create the Tax WTH tax group and attach the WTH tax code in this group.

If you want to attach/apply multiple taxes to invoice, then we can create WTH tax group and then attach the tax codes to this Tax group.

In invoices we can apply the tax group and tax codes both , if we will apply tax group , then automatically all the taxes under that tax groups will attach to these invoices.

Step 7: Tax details updates

Path: Accounts payables >> Supplier >> Entry >> Tax details

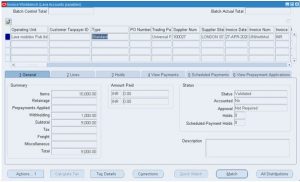

Step 8: Invoice creation including withholding tax

Path: AP >> Invoices >> Entry >> Invoices

Once done while creating an invoice it will automatically reflect in WTH and tax will be apply to the invoice in the Invoice lines as below