Description

Invoices and Credit Memos in Oracle AR:

Invoice: A document that will convey how much the customer has to pay for the goods and services he has bought and due date for paying the amount.

Credit Memo: Negative amount to decrease the balance of the invoice.

Balance of Invoice: The amount that the customer has to pay

Manual AR Invoice.

Please find the below steps for creating AR Transaction with GST

Responsibility: India Local Receivables

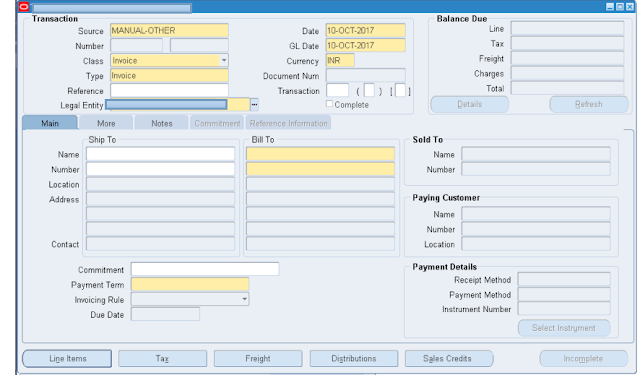

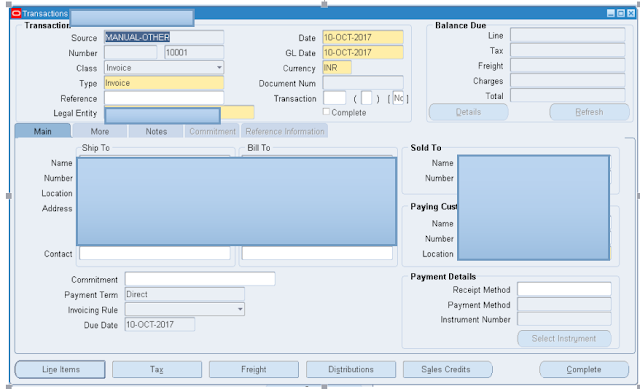

Step 1:Navigation> Oracle Receivables > Transactions > Transactions

Provide the Source,

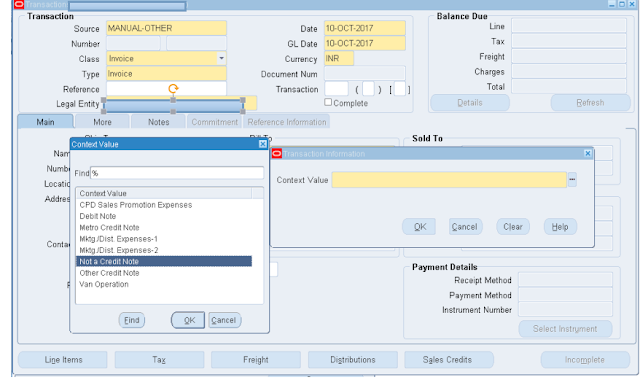

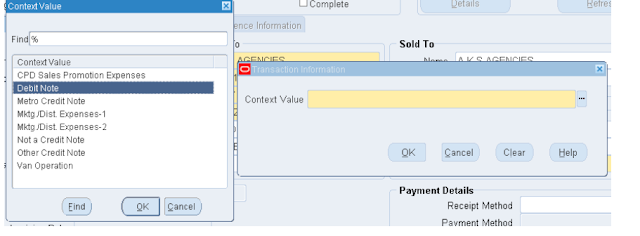

Step 2:Select the DFF

Click on ok

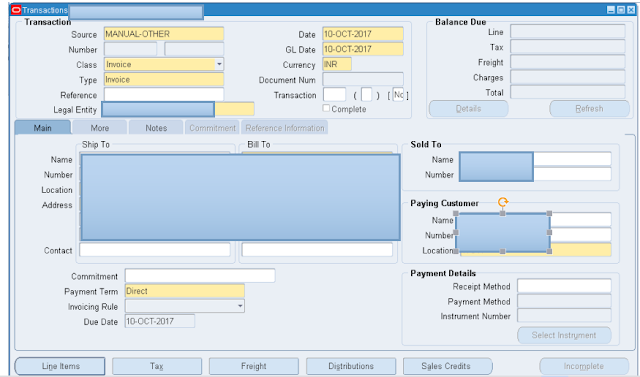

Step 3:Provide the Ship to and Bill to Address and click on the line items.

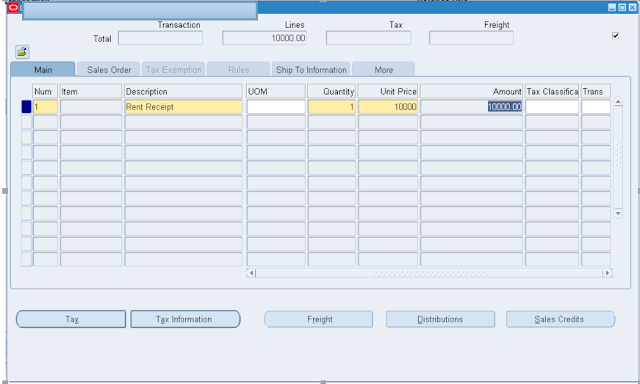

Provide the Description, Quantity, and Unit Price.

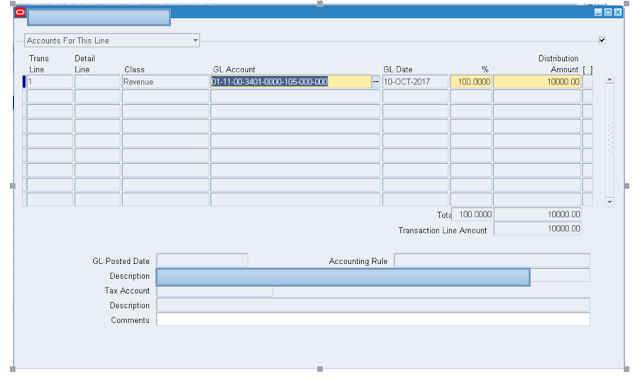

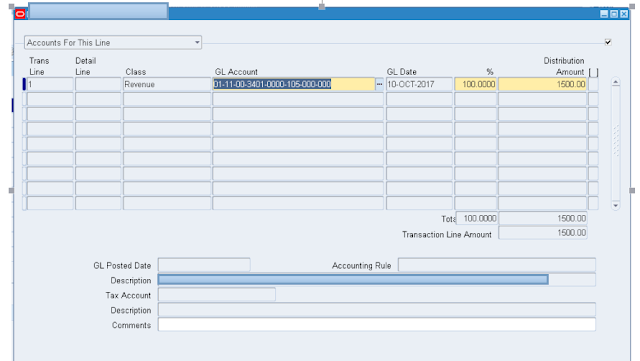

Click on Distributions.

Provide the GL Code Combination and Amount.

Save the screen.

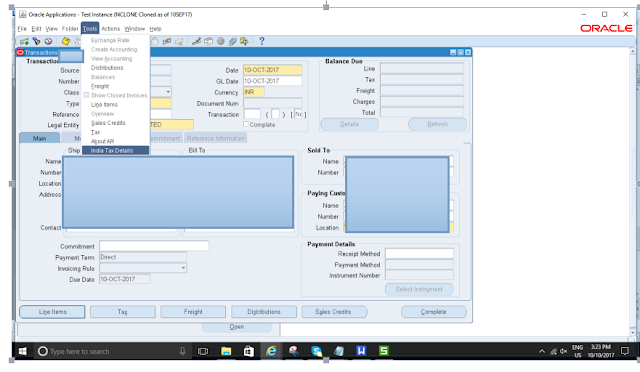

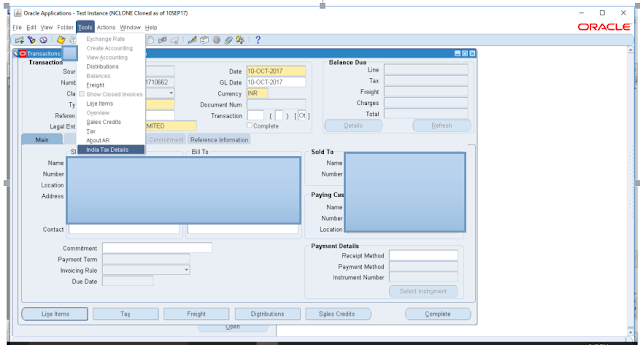

Step 4:Come back to Transactions screen and click on Tools > India Tax Details.

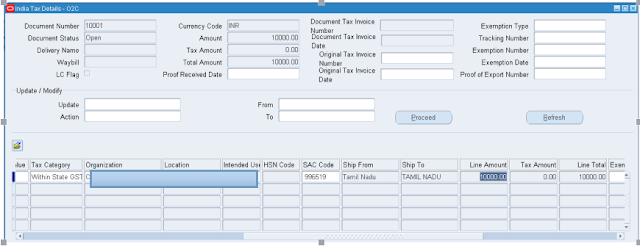

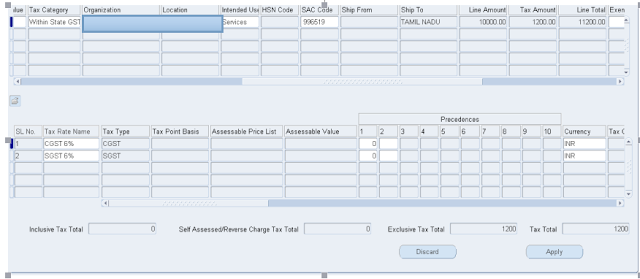

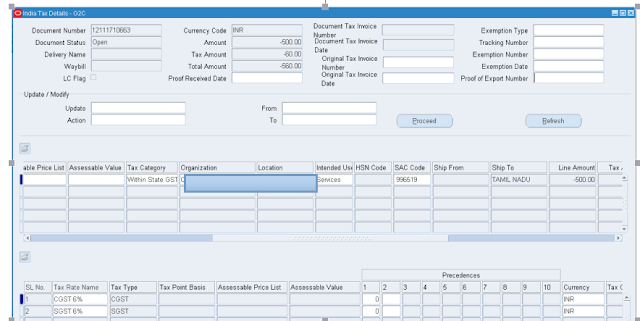

Provide Tax Category, Organization, Location, Intended user, and SAC Code.

Apply and Save, make sure that the tax lines get defaulted in the below lines.

Save

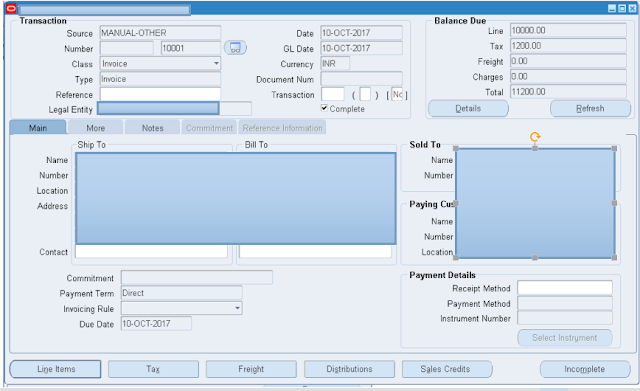

Click on Complete

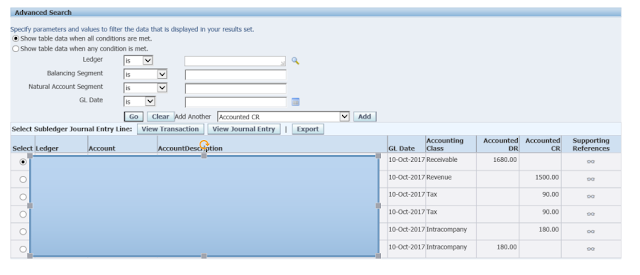

Step 5:Process Create Accounting

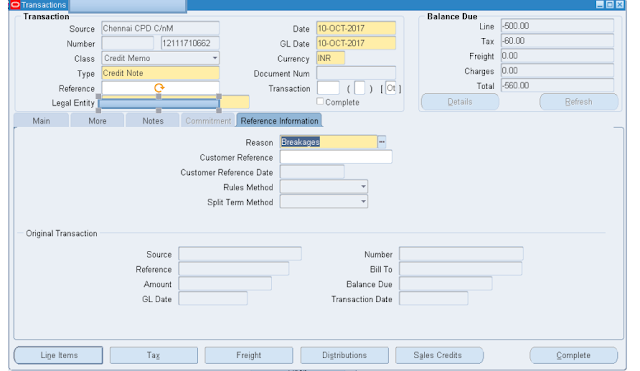

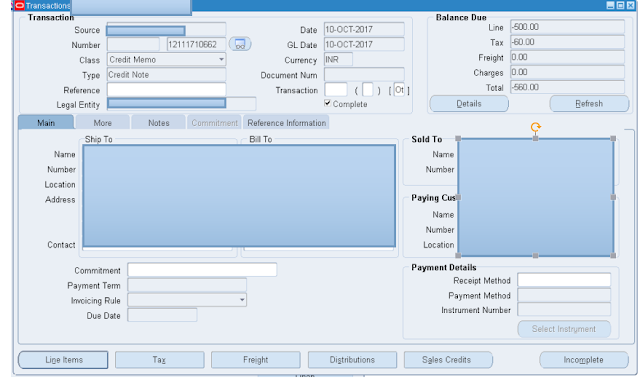

Manual Credit Memo:

Responsibility: India Local Receivables

Navigation: Oracle Receivables > Transactions > Transactions

Select Source, Class (Credit Memo)

Provide Ship to and Bill to Address.

Provide the information in the lines.

Click Distributions.

Provide the account code combination and amount.

Save it

Go back to Transactions Screen and click on Tools > India Tax Details.

Provide the information and apply and save.

Make sure that the tax lines get populated.

Select the Reason.

Save

Click complete.

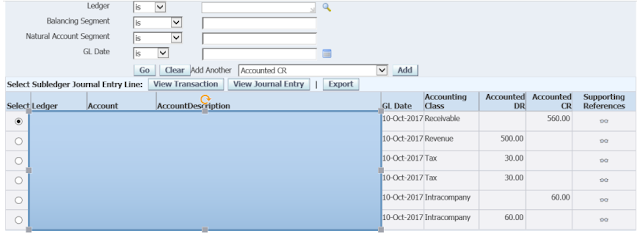

Process Create Accounting.

Accounting Entry

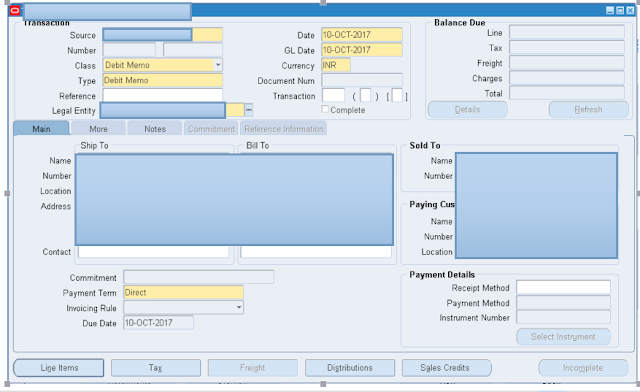

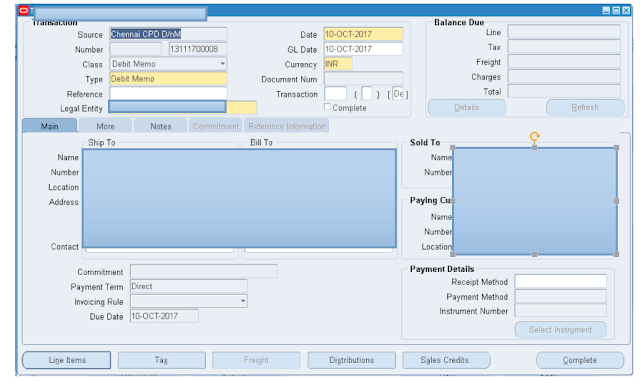

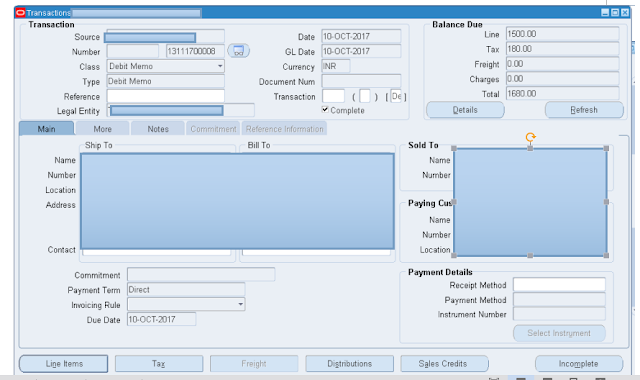

Manual Debit Memo:

Responsibility: India Local Receivables

Navigation: Oracle Receivables > Transactions > Transactions

Provide Source, Class, Ship to, and Bill to address.

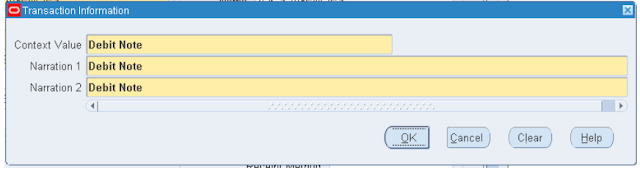

Click on DFF and click on Debit note.

Click ok

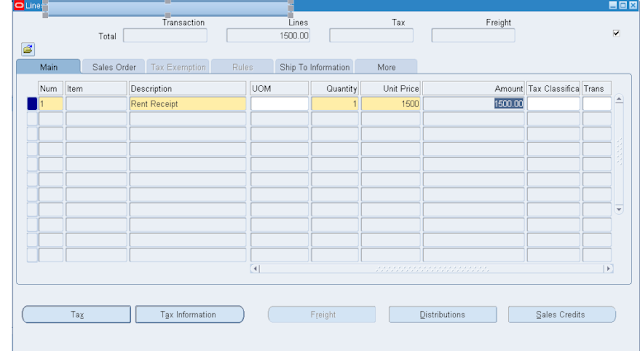

Click on Line Items

Provide Description, Quantity and amount.

Click on Distributions

Provide the account code and amount and save

Go back to Transactions screen and click on Tools > India Tax Details.

Provide the Tad category, Intended user and Sac code, and save.

Make sure that the tax lines got populated and click on Apply.

Come back to the Transactions screen and complete the transaction.

Process Create Accounting

Accounting Entry

queries?

Do drop a note by writing us at doyen.ebiz@gmail.com or use the comment section below to ask your questions.