Introduction:

- The Legal Entity information in the Payable invoice is discordant with the Accounting Legal Entity.

- At the payment run, the Payment Process Request selected invoices for the incorrect Legal Entity and causes intercompany transactions.

- For intercompany balancing rules not in place due statutory requirements and cannot be turned on.

- Oracle does not support automatic Legal Entity updates. To account these payments the process listed below have to followed and then reversed.

Setup:

Step: 1

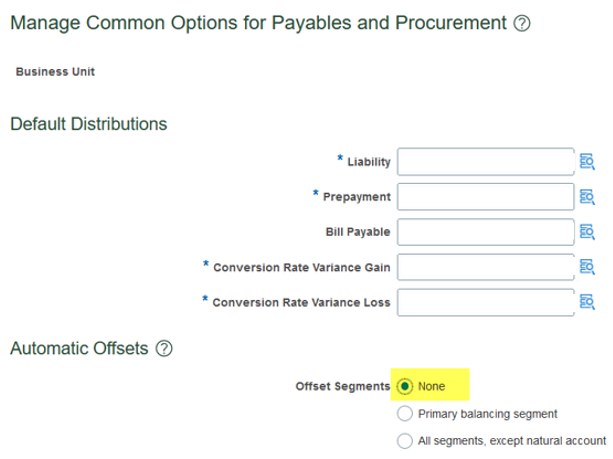

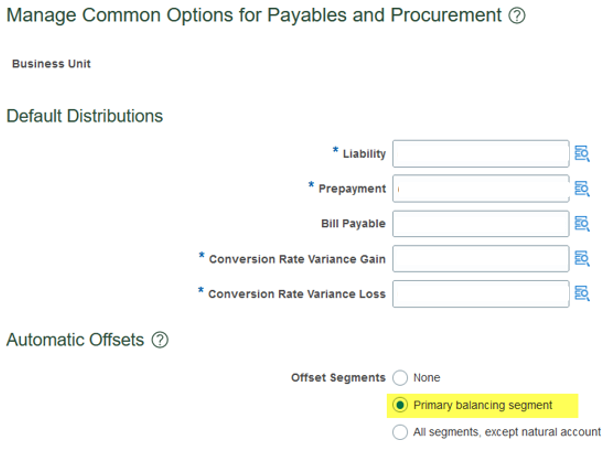

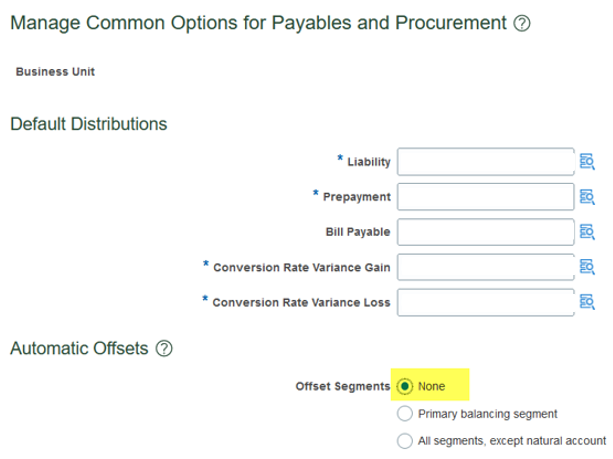

- Turn on automated off-set for France.

Setup & Maintenance à Payables à Manage Common Options for Payables and Procurement à Select BU

Before:

After:

Step: 2

- Before activating the Accounting Methods, Run the Create Accounting for the ledger and ensure only payments are not accounting because the missing intercompany account balancing rule.

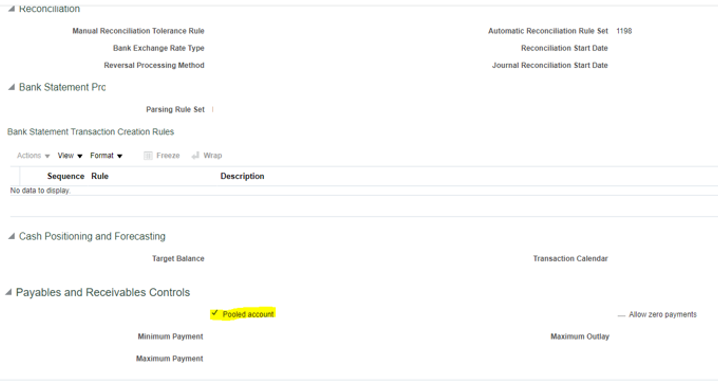

- Update the bank account in the Create Accounting report to Pooled Account. Setup & Maintenance à Cash Management à Manage Bank Account

Step: 3

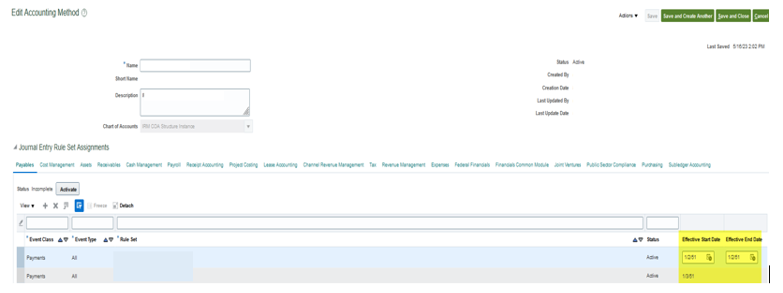

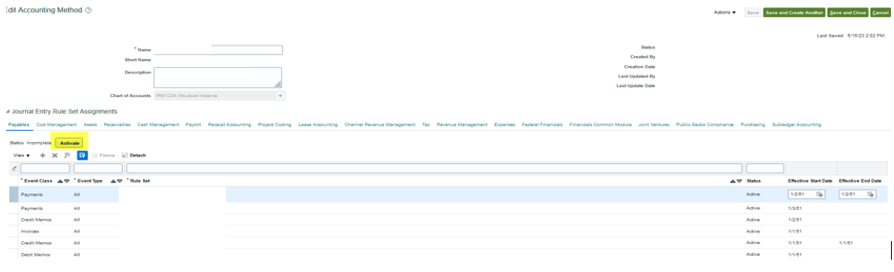

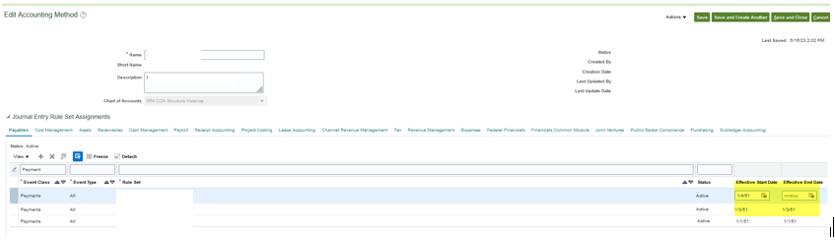

- Navigate to Manage Accounting Methods.

- Click on the Standard Accrual

- End date the current Event Class: Payment and add a new record with the Rule Set created.

- Activate the Accouting Method

Step: 4

- Businnes should Run Create Accounting.

- Ensure all payments are cleared.

- Business will need the create accounting execution report to reconcile the payment amounts.

- After all payments are cleared:

- Deactivate the Journal Rules ser created to fix the Legal Entity issues for the Global COA and France COA by adding an End Date and Reenable the previous one by removing the end date and adding a start date Day+1.

- Disable the automatic off-sets. Step-1

Step: 5

Step: 6

- Turn off automated off-set for France.

Setup & Maintenance à Payables à Manage Common Options for Payables and Procurement à Select BU

Conclusion:

After we made changes as per above solution and issue got fixed

Recent Posts