Description

A Purchase order is a commercial document and first official order issued by the buyer to the supplier, indicating types, quantities, and agreed prices for products or services the supplier will provide to the buyer. A purchase order is required to fulfill demand. … Used for One-time purchases for goods and services

In GST, purchase orders can be either local or interstate. Which means a local purchase order will have CGST and SGST on it, and an interstate one will have IGST on it.

Please find the below steps for creating the Purchase Order creation with GST

Responsibility: India Local Purchasing

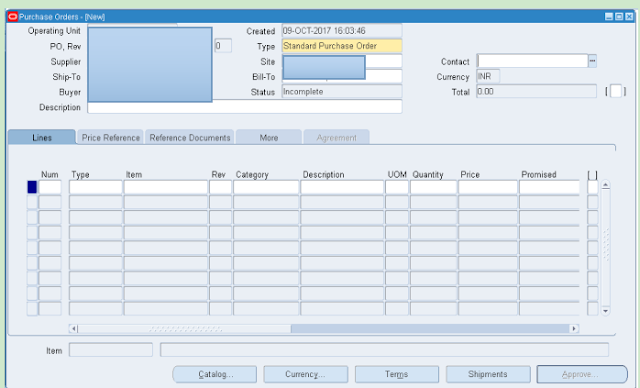

Step 1:Navigation> Oracle Purchasing > Purchase Orders > Purchase Orders

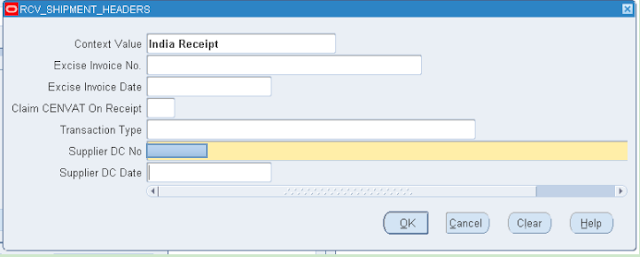

Select the DFF and click ok

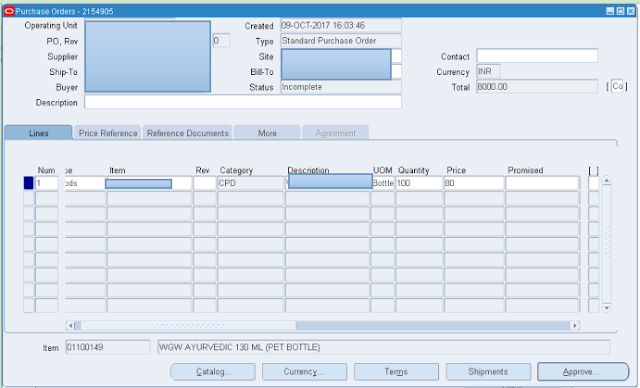

Save

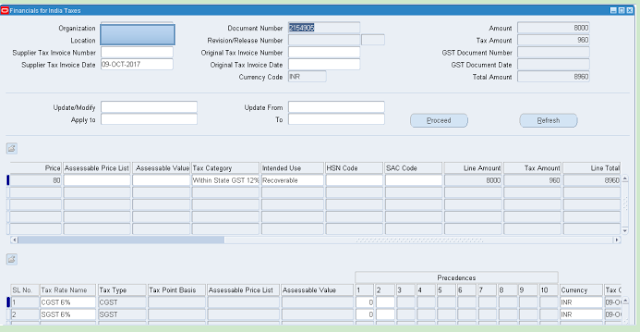

Step2:Provide the Tax Category and Intended user

Save the work.

Click on Apply and save.

Make sure that the Recoverable Checkbox is enabled.

Come back to the PO Screen and click on Approve.

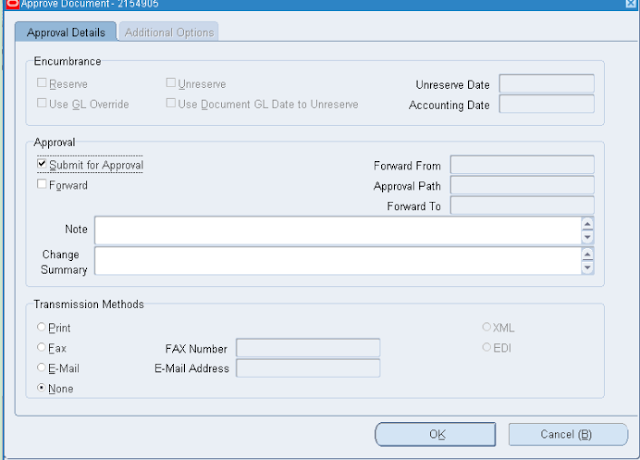

Click ok

The Status will change to Approved.

Step 3:PO RECEIPT:

Responsibility; India Local Purchasing

Navigation: Oracle Purchasing > Receiving > Receipts

Select the Inventory Org.

In Receipts Screen, provide the PO Number.

Click Find

Select the DFF.

Click Ok

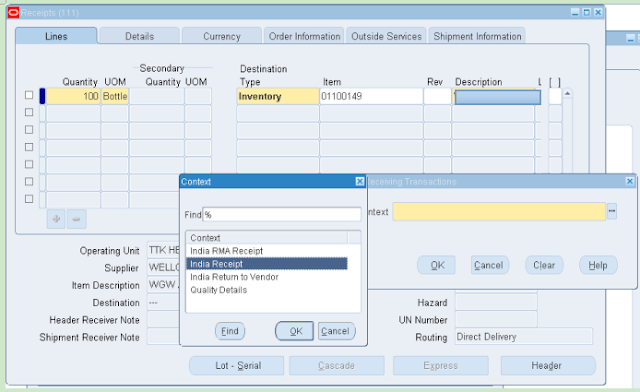

Select DFF

Select India Receipt

And click, ok.

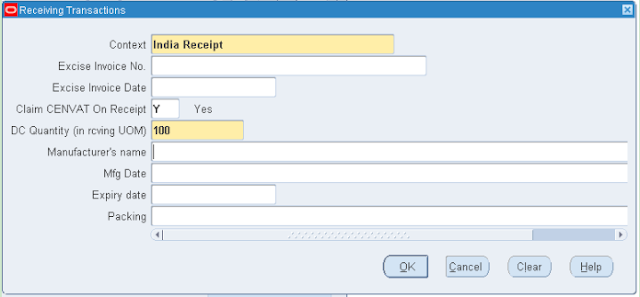

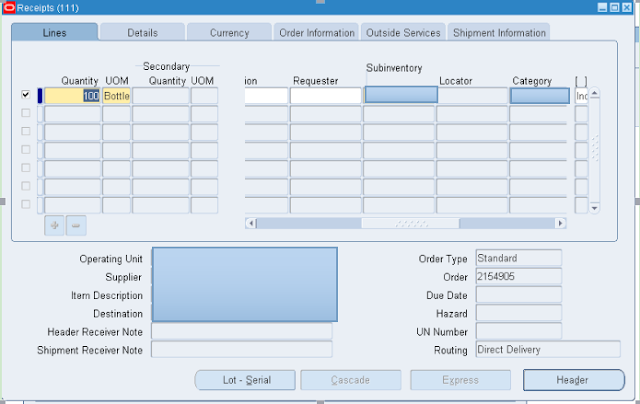

Provide Quantity.

Click ok.

Give Sub-inventory and click on Lot-Serial.

Provide the lot number and quantity,

Click on Done.

Click Ok

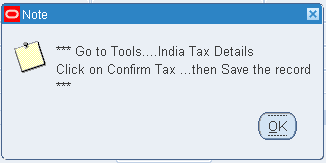

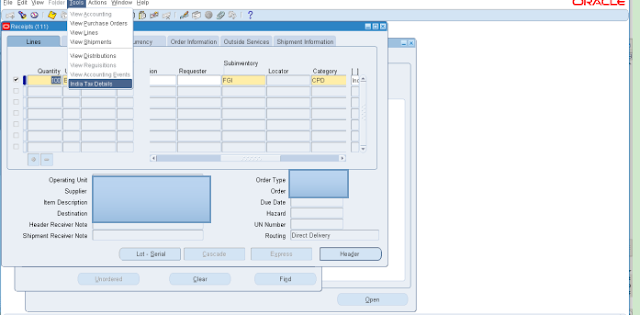

Go to Tools > India Tax Details.

Make sure that the tax gets defaulted, and the Recoverable checkbox is enabled.

Click on Confirm Tax Checkbox.

The system will pop up the message, “Taxes has been confirmed successfully.”

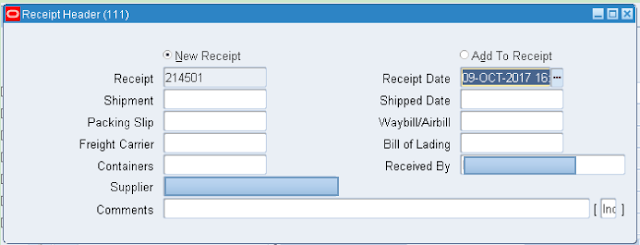

Click ok and save.

Save

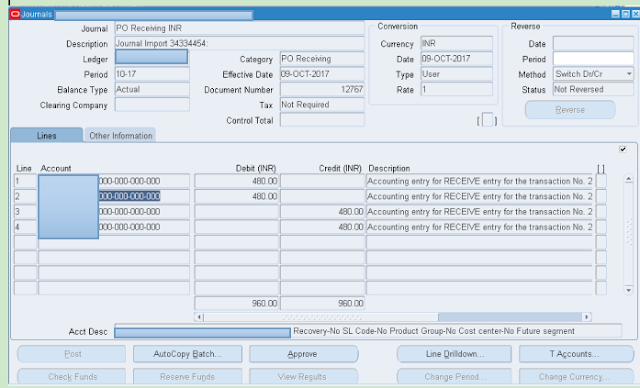

Base entry for the Receipt:

PO Receipt Entry

Tax Amount:

Step 4:AP Invoice Processing:

Responsibility: India Local Payables

Navigation: Oracle Payable > Invoices > Entry > Invoices

Enter the data

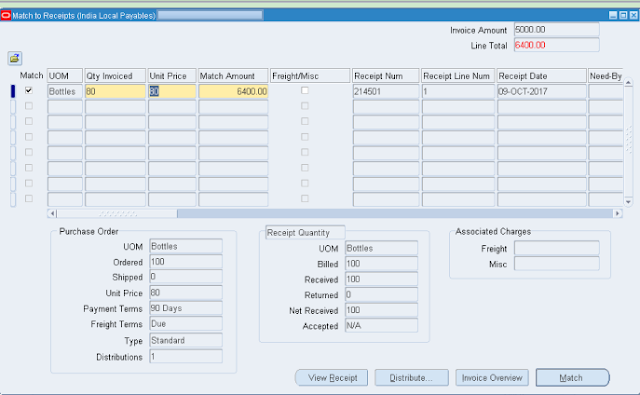

Click on Match

Provide the Receipt number

Click on find.

Select the match Checkbox against the line.

Click on Match.

Save and click on Tools > India Tax Details.

Click on Apply and Save.

Click on Actions and select Validate

Create Accounting

Click ok

Summary

This post detailed how the GST will apply in procure to pay process in Oracle EBS R12

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.comor use the comment section below to ask your questions.