Description:

BOE is a legal document in a prescribed format that needs to be submitted to the Customs Authority by the importer or his authorized agent. BOE contains information of the goods imported to India, value and other relevant details that is required for assessment of Customs duty

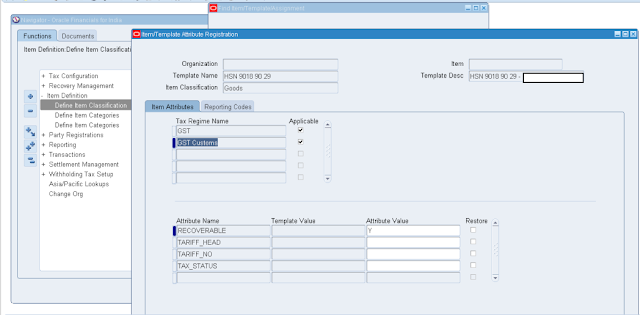

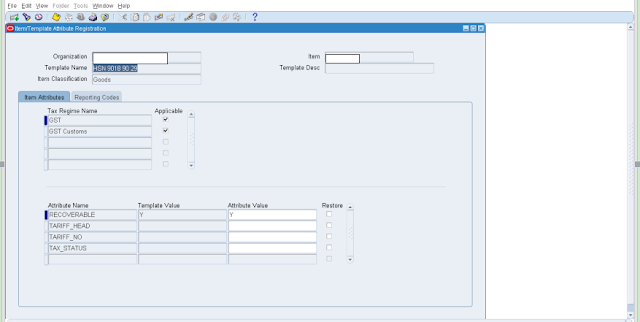

Step1 :Item Needs to be assigned as GST & GST customs and recoverable tax to be given as Y

Step 2:Item Definition -> Define Item Classification

Choose

Item Template

Template Name

Step 3:Select GST customs and recoverable as Y

And give the reporting code HSN code

Step 4:Supplier needs to be registered as a third party with TIN number.

Step 5:PO Creation :

Responsibility: India Local Purchasing

Navigation: Oracle Purchasing -> Purchase Order

Enter Supplier name, site Ship to & bill to locations

Enter the item details item code, quantity, price

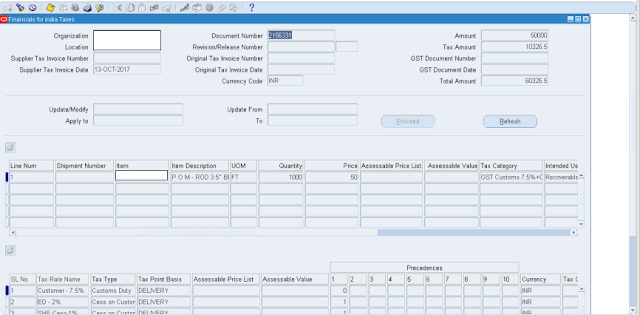

Click on Tools -> India Tax Details

Step 6:Enter the tax category and intended use.

Save and click on apply

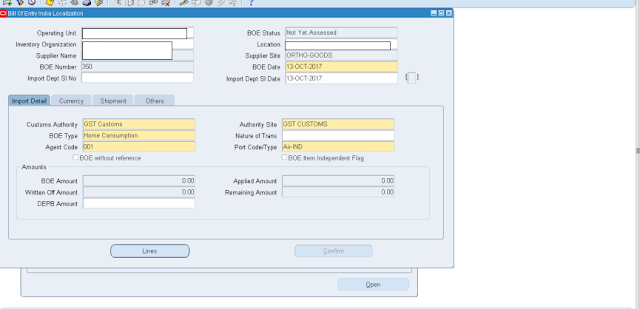

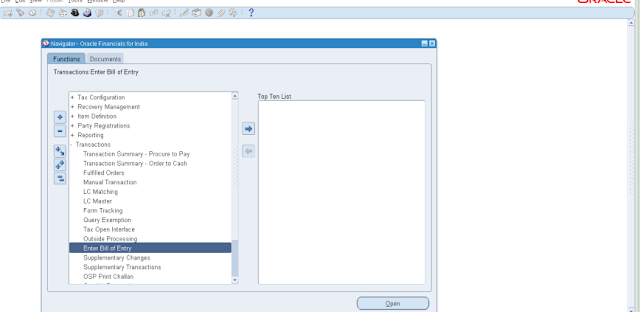

Step 7:Creation of Bill Of Entry

Responsibility: Oracle Financials for India

Navigation : Transactions -> Enter Bill of Entry

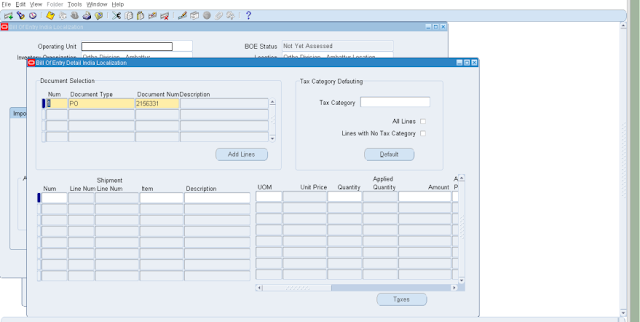

Enter the Supplier name, site, organization name, location, BOE type, and other details as shown in the above screenshot and Save it.

BOE number will get generated, note it

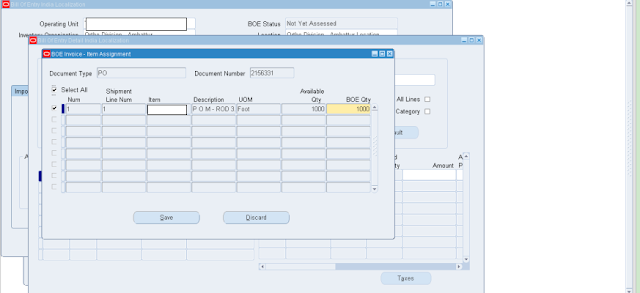

Click on lines

Enter the PO number and save it and click on add lines PO item details will appear.

Information related to the PO will get automatically populated.

Close the screen.

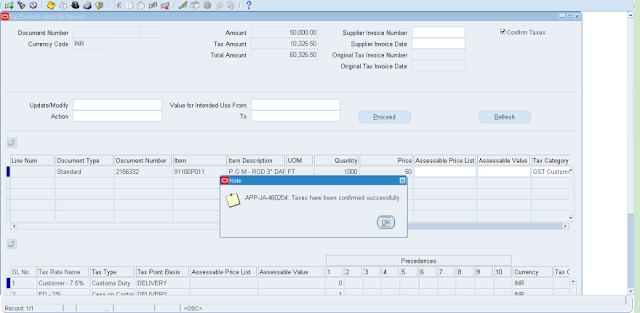

Step 8:Click on Taxes

Click on apply.

Save it.

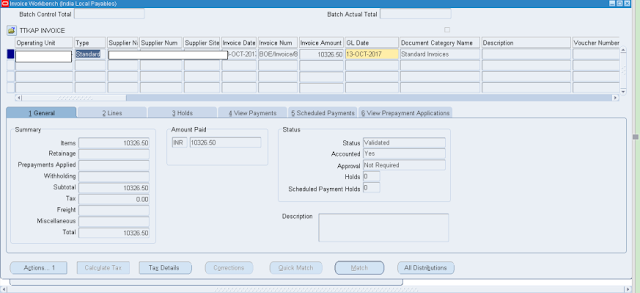

The Following concurrent will automatically create Invoice and validate it.

Importing BOE Invoices – Localization (Payables Open Interface Import)

Calling Payables Approval Localization (India – Auto Invoice Approval)

(BOE invoice number will be created by this concurrent as first parameter note it) Ex: BOE/Invoice/82/351

Payables Approval Localization (Invoice Validation)

Check the invoice and match the amount and make payment.

Accounting Entry for Invoice

Step 9:Go to BOE screen

Enter the Inventory Organization and location and Click Supplier and query for the BOE number

Step 10:Click on Tools -> BOE receipt Creation

Enter PO number and find it

The PO line will get populated and select the PO line, click on tools -> India tax details.

Make sure the tax Details are populated correctly.

Select the Confirm Tax Checkbox and Save.

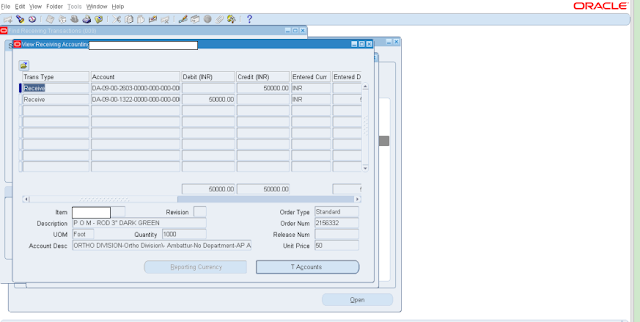

Receipt GL entry

Receive:

Delivery:

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.com or use the comment section below to ask your questions.