Description

Oracle Fusion Tax can automatically create withholding tax invoices, or you can perform this task manually. To create withholding tax invoices automatically, set the Tax Invoice Creation Point option to specify whether to generate withholding invoices at invoice validation or payment.

Please find the below setups for Creating the Customer

Step 1: Login as Application User

Step 2: you will be on the home page as below.

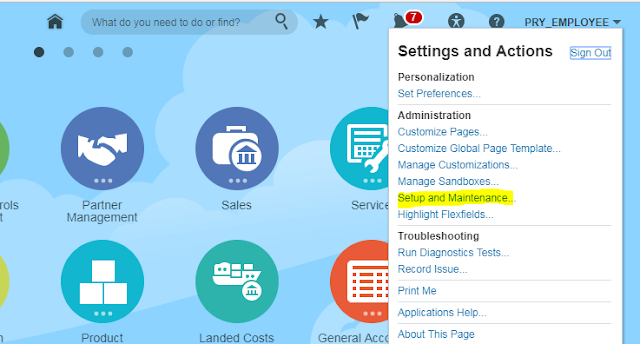

Step 3: we need to navigate to Functional Setup Manager, click on User Name, and you will be able to see Setup and Maintenance option. It will navigate you to functional setup manager.

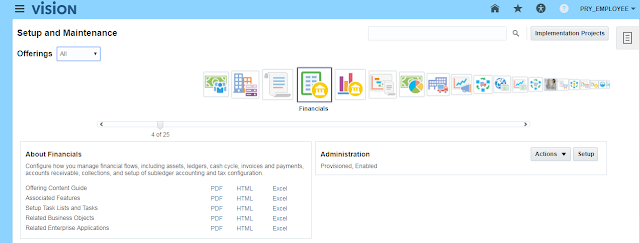

Step 4: below is the functional setup manager window; we could able to see all the offerings as provisioned and enabled

Step 5: we could see Financial’s Offering as provisioned and enabled; we need to click on the Implementation projects button in the below screenshot.

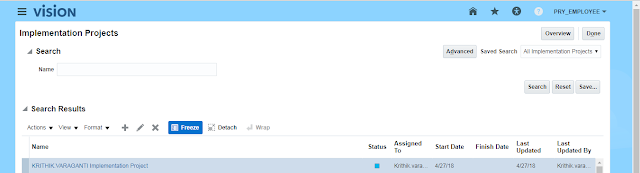

Step 6: Search for our Project in the search window.

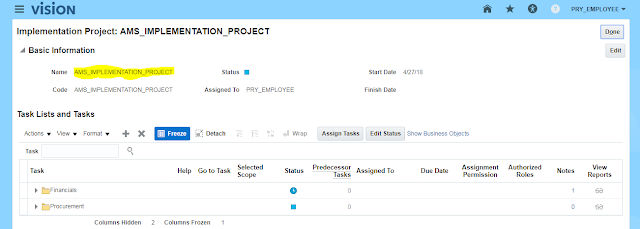

Step 7: Click on the project name (hyperlink), it will open the project page

Step 8:Creating Withholding tax authority as Supplier

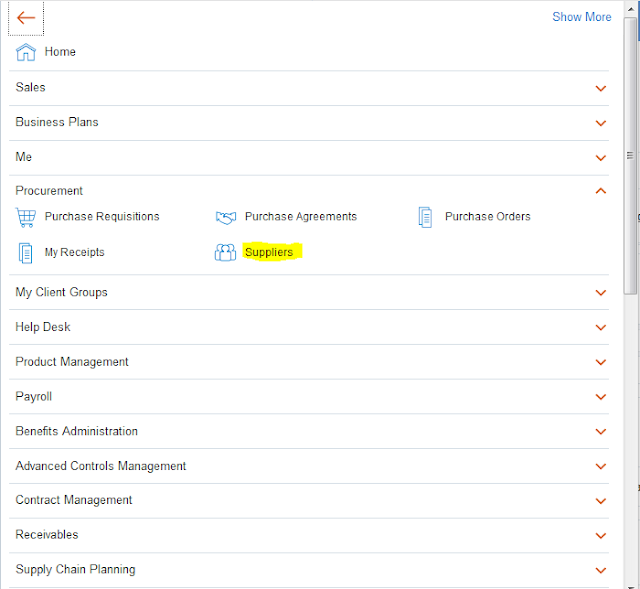

Go to Navigator select the Procurement offering and Click on Supplier

Step 9:Click on Create Supplier

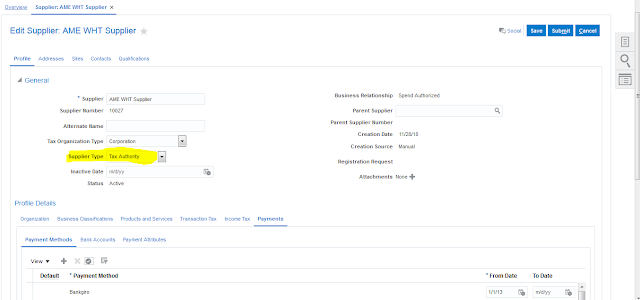

Step10: In the below screen we can enter the required information and click on Create button

Step 11:Select the Supplier Type as Tax Authority.

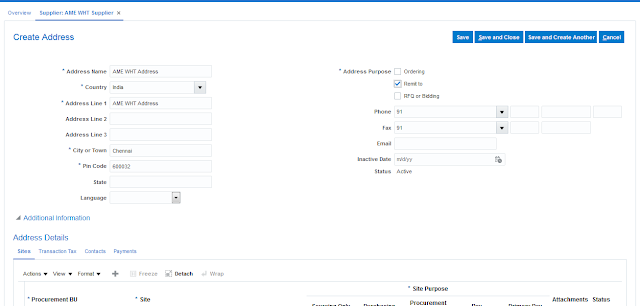

Step 12:Supplier Site Address Creation:

Step 13:Supplier Site Creation: when creating the Supplier site, we can enter all the required information.

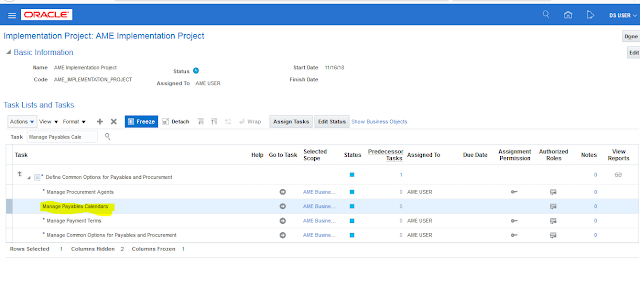

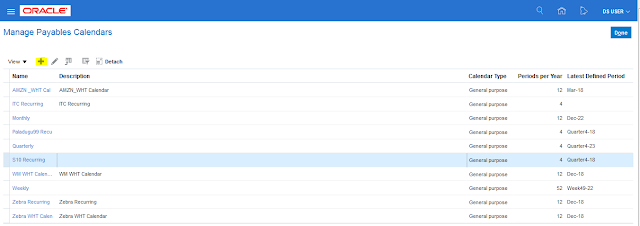

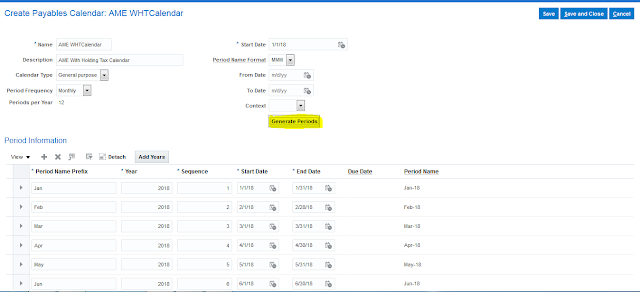

Step 14: Creating With Holding Tax Calendar

Manage Payables Calendar go to Task option

Step 15:Click on the + Symbol for creating the WHT Calendar

Step 16:Enter the Required information for Creating the WHT Calendar an click on Generate the periods so that system automatically system generate WHT Calendar for 12 periods like Jan to Dec

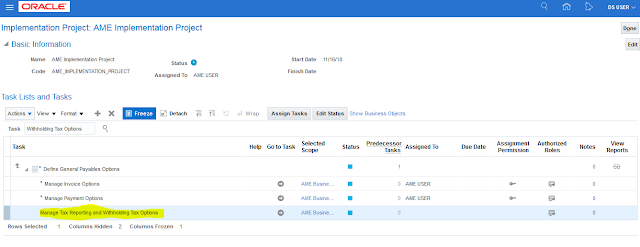

Step 17:Setup the WHT Options:

Go to Implementation project and search the task With Holding Tax options

Manage Tax Reporting, and WHT Options click on Go to Task

Step 18:Enter the Required information for WHT options and then save and close.

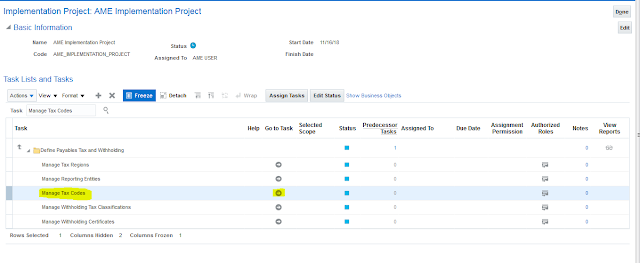

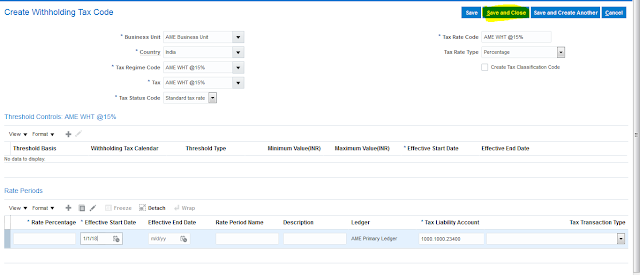

Step 19:Creating the Tax Codes

Go to Implementation project and search the task Manage Tax Codes and Go to Task

Step 20: Creating Tax codes enter all the required information and Save and Close

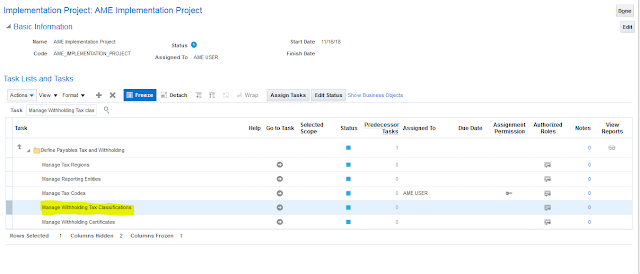

Step 21:Creating the Tax Group:

Go to Implementation project and search the task Manage Withholding Tax Classification and Go to Task

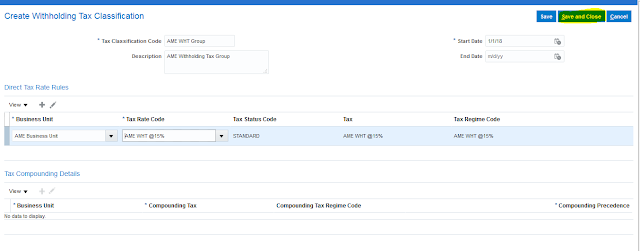

Step 22:Click on + Symbol for creating the Tax Group

Step 23:Enter the Required information and then save and close.

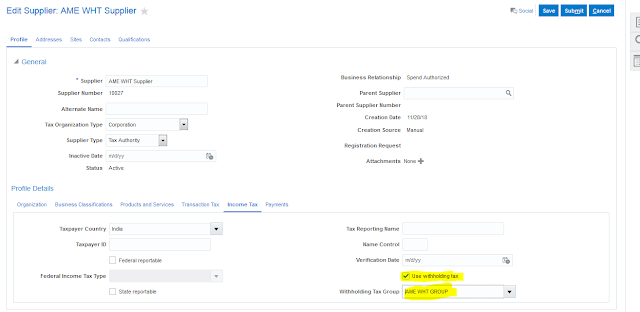

Step 24:Assign Tax Group/ Tax Classification to Standard Supplier

Go to Navigator select the Procurement offering and Click on Supplier

Step 25:Click on manage Supplier

Step 25:Supplier Profile option and go to Income Tax options Enable the Checkbox Use WHT Group and Select the WHT Group in LOV and Save and close the screen

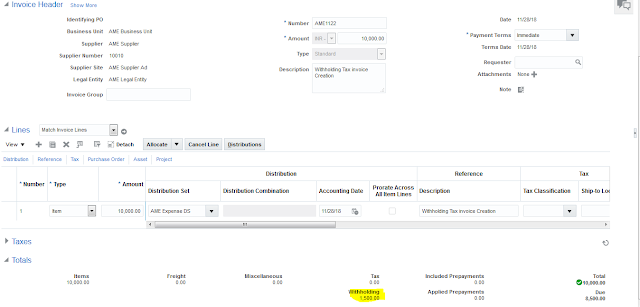

Step 25:Create the Standard Invoice

Go to Navigator select the Payable offering and Click on Invoices

Go to Task Icon and click on Create invoice.

Step 26:Enter the Required information for creating the WHT Invoice and Validate it.

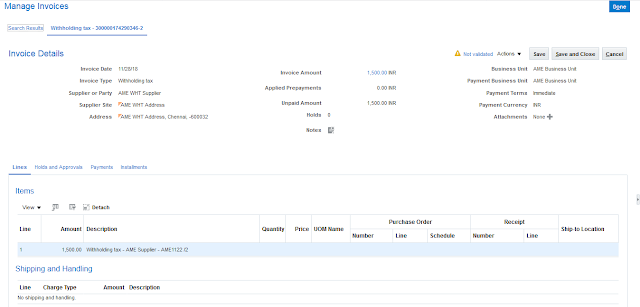

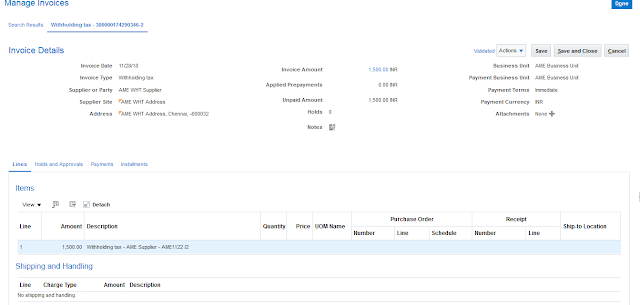

Step 27:Query the Withholding Tax invoice and Validate it.

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.com or use the comment section below to ask your questions.