Description

Suppliers are responsible for issuing invoices and charging GST at a specific rate of tax on the goods and services they provide to the customers. The GST amount is included in the price paid by the recipients of the goods and services. The suppliers must deposit this GST amount to the tax authority after collecting the amount from the customers.

Therefore, while the suppliers charge GST on the supply of goods and services, they do not keep the GST amount they collect. Customers get GST credit (ITC) on the purchases they made. Customers can utilize the GST credit to offset the GST liability on their sales transaction.

Responsibility: India Local Order Management

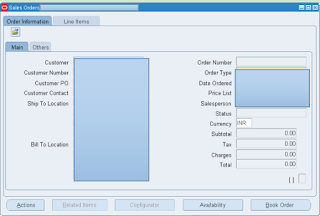

Step 1:Navigation> Oracle Order Management > Orders, Returns > Sales Order

In Sales order Screen, provide the information.

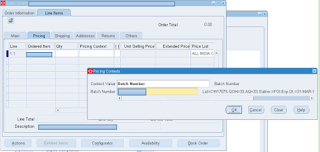

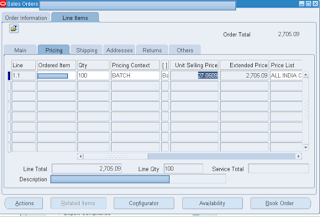

Step2:Click on line Items Tab.

Provide the item and click on the pricing tab.

Step 3:Provide the item and click on DFF

Provide the Batch Number.

Click OK.

Provide quantity

Click on Order information Tab.

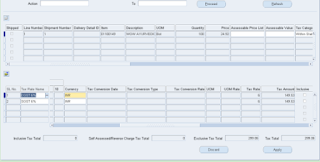

Step 4:Click on Tools > India Tax Details.

Make sure that the Tax category gets defaulted.

Click on Apply and save.

Order No: 11110330998

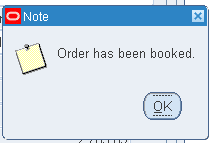

Step 5:Click on Book Order.

Click ok.

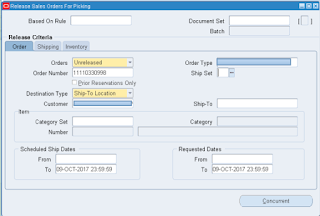

Step 6:Releasing the Order.

Responsibility: India Local Order Management.

Navigation: Oracle Order Management > Shipping > Release Sales order > Release Sales order.

Provide the Order Number and click tab.

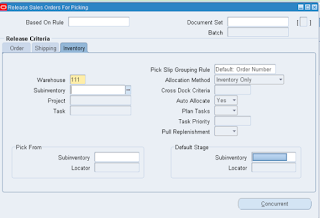

Click on Inventory tab.

Provide the Warehouse and click on Concurrent.

Click Ok.

Click on View > Request

Responsibility: India Local Order Management

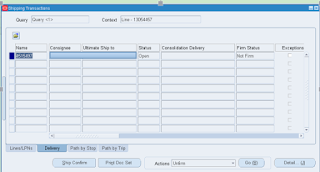

Step 7:Navigation: Oracle Order Management > Shipping > Transaction

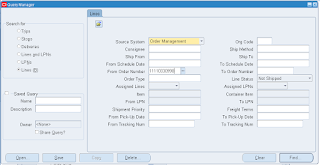

Provide the Order Number and click on find

Click on Delivery Tab.

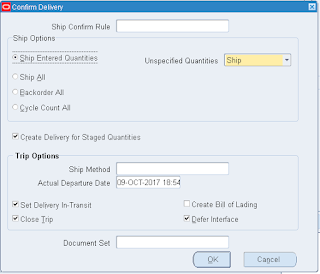

And click on Ship confirm.

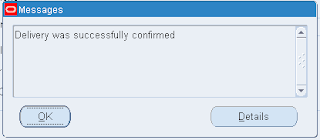

Click Ok.

Click Ok.

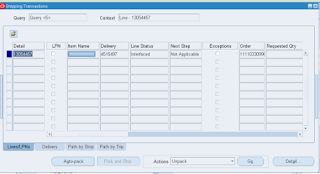

Query the Shipping Transaction and make sure that the Line Status should change to Interfaced.

Journal entry for base amount

Journal entry for Tax amount.

Step 8:Run Auto Invoice program.

Navigation: Oracle Receivables > Interface > Autoinvoice.

Click on Ok and Submit

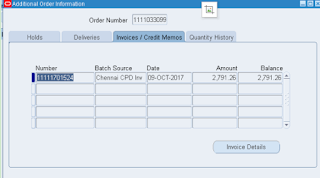

Query the Sales Order

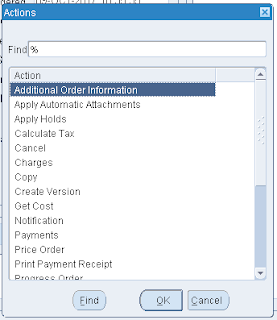

Click on Actions

Click on ok

Take the Invoice Number. 11111701524

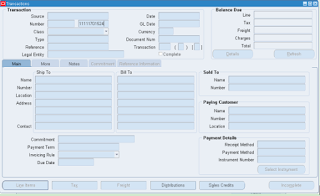

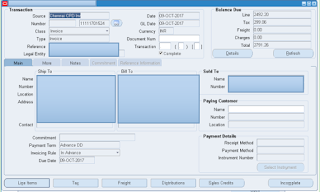

Go to Transactions Screen.

Responsibility: India Local Receivables.

Navigation: Oracle Receivables > Transactions > Transactions.

Process Create Accounting.

View Accounting:

Summary

This post detailed how the GST will be applicable while creating the sales order in Oracle EBS R12

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.com or use the comment section below to ask your questions.