Description

IRISO Stands for Internal Requisition Internal Sales Orders. IR ISO is used to transfer the material from one inventory organization or warehouse to another with in the same company. IR ISO tracks the material movement in the system. Oracle IRISO process is designed only between 2 operating units.

In this post explained how goods service tax(GST) would apply in IRISO process.

Please find the below setups for IRISO:

Step 1:Requisition

Responsibility: India Local Purchasing

Navigation: Requisition Summary > Requisitions

Enter the Item, Quantity

Enter Destination Org

Enter Source Org

Save

Step 2: Place the cursor on the header and click on

Tools > India Tax Details

Enter Tax category, and Intended use.

Make sure that the Recoverable Check box is enabled.

Make sure to click Apply button and save.

Click on Approve

Click OK.

To check the Requisition, click on Enter Requisitions India.

Query the requisition with number

Step 3:Click View > Request

And run “Create internal Order program.”

Click no

Step:4 Run Order import program

Order Import:

Responsibility: India Order Management

Navigation: Oracle Order Management > Orders, Returns > Import Orders > Order Import Request.

In oracle import request screen, provide the information.

Click ok

Click Submit.

Go to Order Organizer and Query for the Requisition Number. “2265067”

Click on Find

Click on Open

Select No Sales Credit in Salesperson column

Click on Line Items Tab.

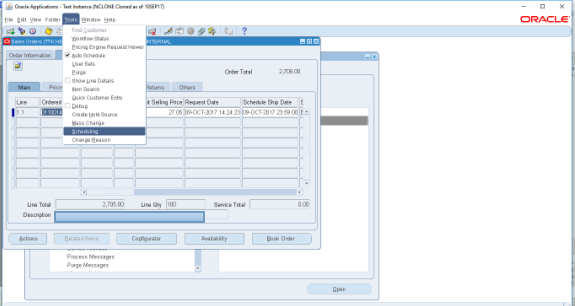

Click on Tools > Scheduling

Select Reservation Details

Click ok.

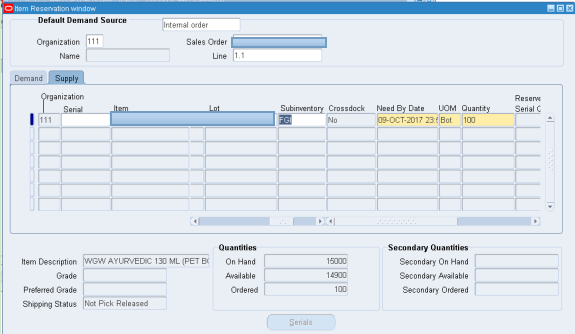

Item Reservation Window will open.

Click on Supply and select Lot and Sub-inventory.

Save the work.

Come back to Sales Order Screen

Click on Book Order

Note will be displayed that the Order has been booked.

Click OK.

Step 5:RELEASE THE SALES ORDER:

Responsibility: Oracle Order Management

Navigation: Oracle Order Management > Shipping > Release Sales Order > Release Sales Orders

Click on Concurrent

Click Ok.

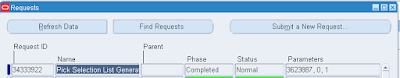

Go to View > Request

The “Pick Selection List Generation” program will get triggered.

To view the journal entry created.

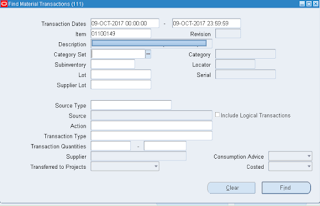

Go to India Local Inventory Responsibility and click on View Material Transactions.

Give the Item and click on find.

Place the curser on the FGI and click on Distributions button.

Step 6:Go to Shipping Transactions form

Responsibility: India Local Order Management

Navigation: Oracle Order management > Shipping > Transactions

Give the order number and click on find.

In Shipping Transactions screen, go to the Delivery tab.

Click on Ship confirm.

Click on Ok

Click Ok.

Make sure that the following programs complete in normal status.

Program Interface Trip Stop – SRS

Program India – Check Delivery OM/INV Interface

Make sure that the Line Status is changed to Interfaced.

Once the Ship confirm is over. (Shipment no: 4515496)

The following journal entries will get generated.

For base mount.

For Tax part.

Inventory Material Value AC DR

TO IGST Liability AC

RECIEPTS:

Responsibility: India Local Inventory

Navigation: Oracle Inventory > Transactions > Receiving > Receipts

Select the Inventory org.

Provide the Shipment No: 4515496.

Click Find

Click the DFF

Select India Receipt.

Provide the supplier DC number and click on Ok.

Click on DFF

Select India Receipt

Select DC Quantity and click on ok

Enter Sub-inventory and

Click Lot Serial

Click on Done

Before saving, please click on Tools > India Tax Details.

Make sure that the tax lines got defaulted and Recoverable Checkbox is enabled.

Save and close

Save

Once saved,

The receipt number will get generated on the header.

Base entry for Receipts:

Tax Entry

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.comor use the comment section below to ask your questions