Description

Return to Vendor(RTV)is used to return the materials to the supplier. If buyer had made PO for certain items and after receiving at inspection section buyer found that some of the ordered materials are defective, then returning of those items is transacted by Return to Vendor(RTV)

Responsibility: India Local Purchasing

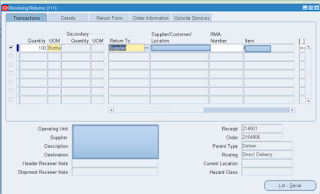

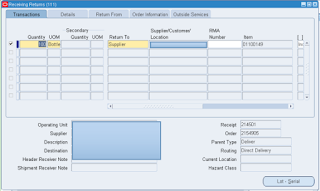

Step 1:Navigation> Oracle Purchasing > Receiving > Returns

Select the Inventory Org

Provide the Receipt number as shown above and click on Find.

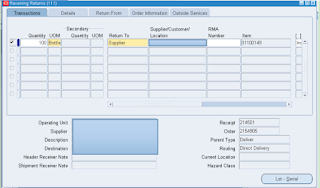

Provide Quantity Returned, and Remit to as Supplier.

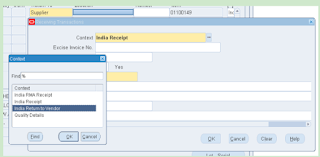

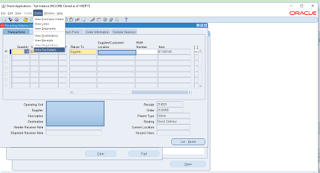

Step 2:Click on DFF

Step 3:Select India Return to Vendor.

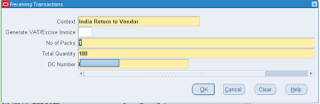

Provide No of Packs and Quantity,

Document Number will be defaulted.

Click Ok.

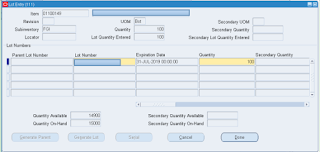

Step 4: Click on Lot Serial

Provide Lot Number and Quantity and click on Done.

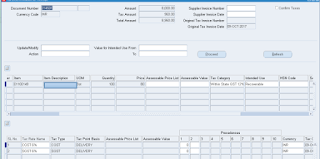

Step 5: Click Tools > India Tax Details

Step 6:Select Tax Category

Step 7:Select Confirm Tax Checkbox and save the work.

Save the work.

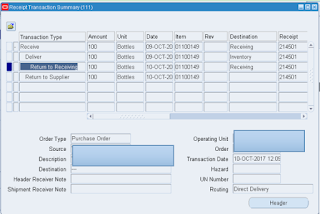

Query the Receipts by going to Receiving Transactions Summary and providing Receipt number.

Return to Supplier

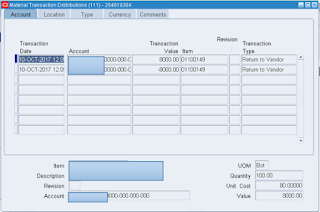

Go to India Local Inventory > View Material Transactions.

Return to Receiving

DEBIT MEMO CREATED FOR THE SAME.

Click Tools > India Tax Details

Click Apply and Save.

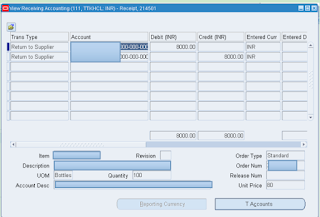

Accounting Entry for Debit Memo

Summary

This post detailed how GST will work while doing the return to vendor(RTV) on purchasing Responsibility in Oracle EBS

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.com or use the comment section below to ask your questions.