Description:

Please find the below steps for Manual AP Invoice Creation and Cancellation with GST

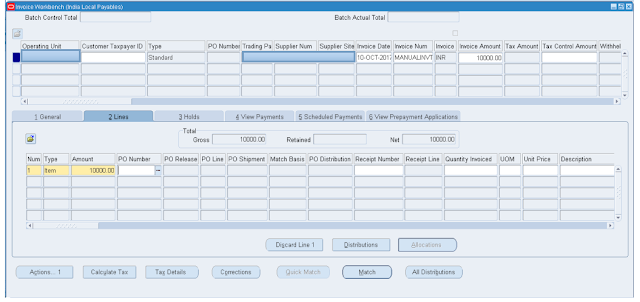

Step 1:Responsibility: India Local Payables

Navigation: Invoices > Entry > Invoices

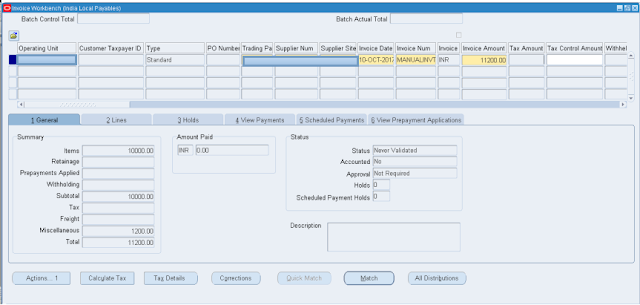

In Invoice Workbench, provide the supplier name, Invoice Date, Invoice Amount, and Step 2:click on lines Tab.

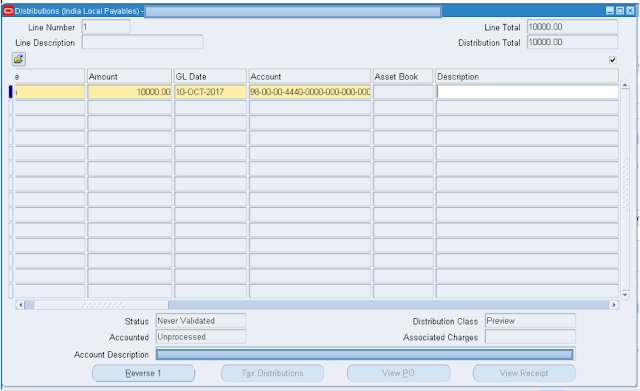

Step 3:Provide the Amount in the lines and click on Distributions.

In Distributions Screen, provide the Amount, GL Date, and Account information.

Save the screen.

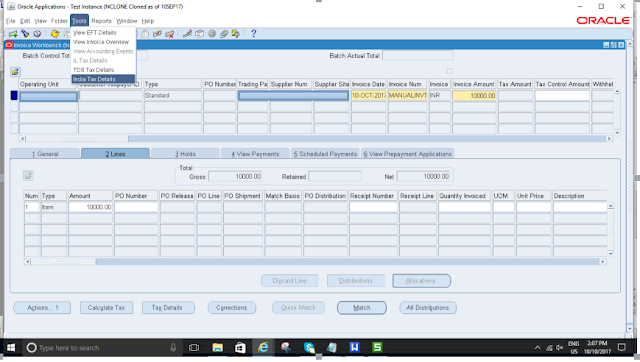

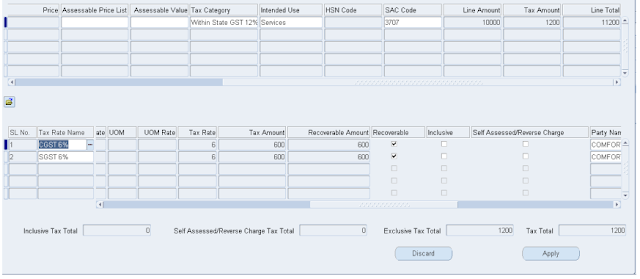

Step 4:Go to Invoice Workbench and click on Tools > India Tax Details.

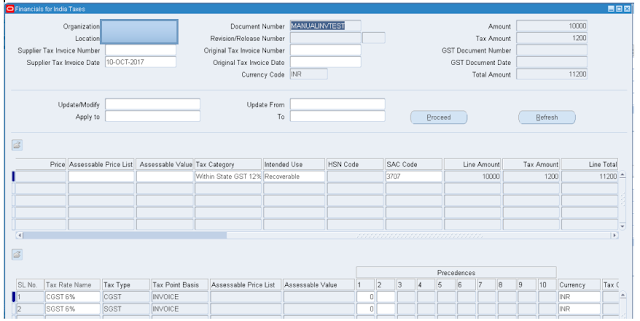

Select Organization, Location, Tax Category, Intended Use, and SAC Code, as shown in the above screen.

Save the screen.

Make sure that the tax lines get defaulted in the lines.

Click on Apply and make sure that the Recovery Checkbox is enabled.

Save.

Come back to the Invoice Workbench screen and make sure that the tax amount gets defaulted in the Miscellaneous column.

Save

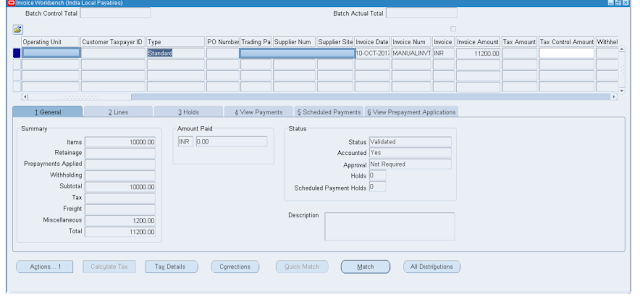

Step 5:Validate and Process Create Accounting.

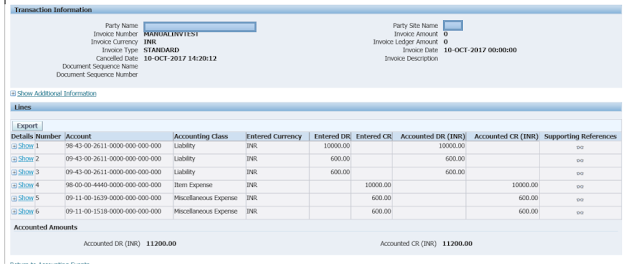

Accounting Entry

AP Invoice Cancellation:

Process Create Accounting

The following Journal entry will be generated.

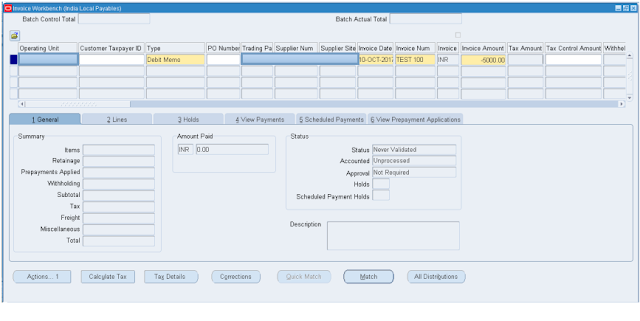

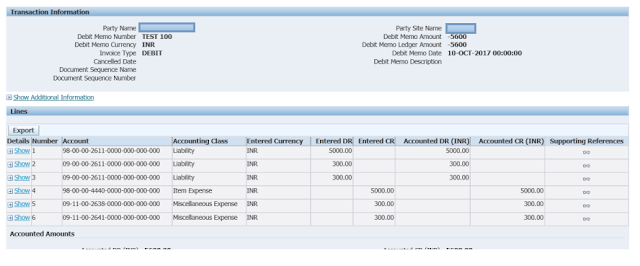

Manual Debit Memo:

Responsibility: India Local Payables

Navigation: Oracle Payables > Invoice > Entry > Invoice

Provide the Supplier name, invoice Date, Amount.

Click on Lines tab.

Enter the Amount.

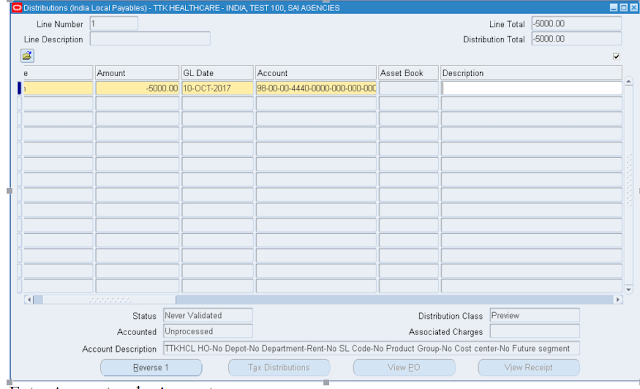

Click on Distributions.

Enter Account code, Amount

Save the screen.

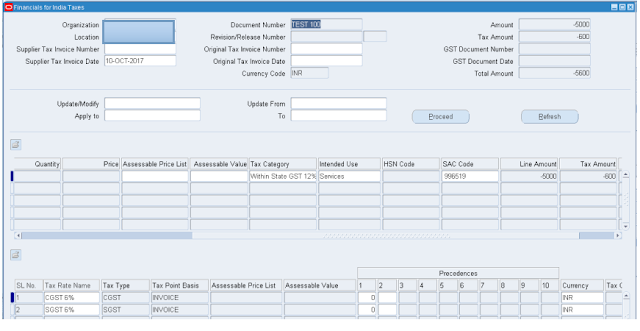

Go to Invoice Workbench and Click on Tools > India Tax Details.

Enter Inventory Org, location, Tax Category, Intended use, SAC Code, and save the work.

Make sure that the tax lines got generated.

Click on Apply and save.

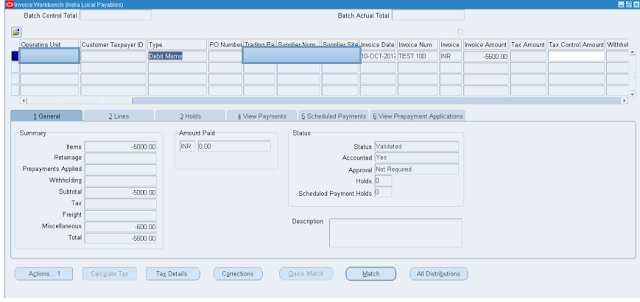

Go to Invoice Workbench screen, Validate and process Create Accounting for the Transaction.

Journal Entry:

Summary

This post detailed how to create the AP(Account payable)invoice as well as cancellation has been done with GST

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.com or use the comment section below to ask your questions