Description

Reverse charge is a mechanism where the recipient of the goods and services is liable to pay GST instead of the supplier.

Typically, the supplier of goods or services pays the tax on supply. In the case of Reverse Charge, the receiver becomes liable to pay the tax, i.e., the chargeability gets reversed.

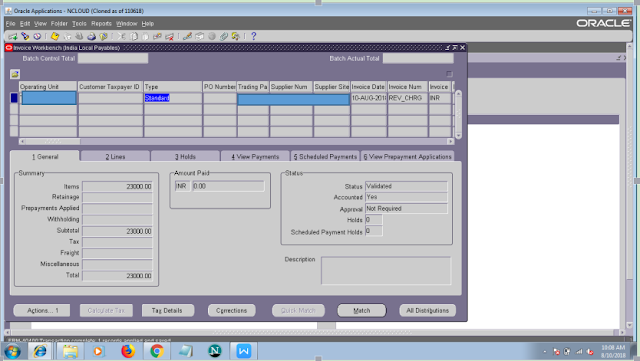

Step 1. INVOICE CREATION:

Step 2.SELECT Tax Category as Reverse Charge

Step 3.Invoice Validated and Accounted

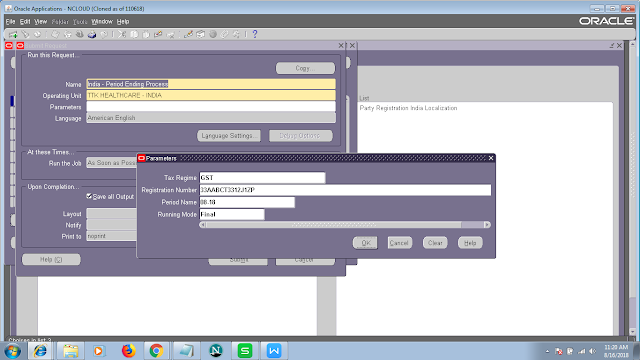

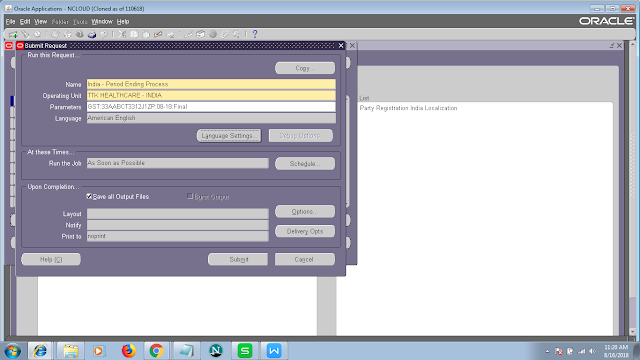

Step 4.Run India- Period Ending Process Concurrent Program

Journal Entry:

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.com or use the comment section below to ask your questions.

Recent Posts